For years, Tesla has been the dominant electric vehicle (EV) manufacturer in the U.S. and a media darling. Since it first launched its inaugural Roadster in 2008, the company has become synonymous with EVs and held the lion’s share of the American EV market.

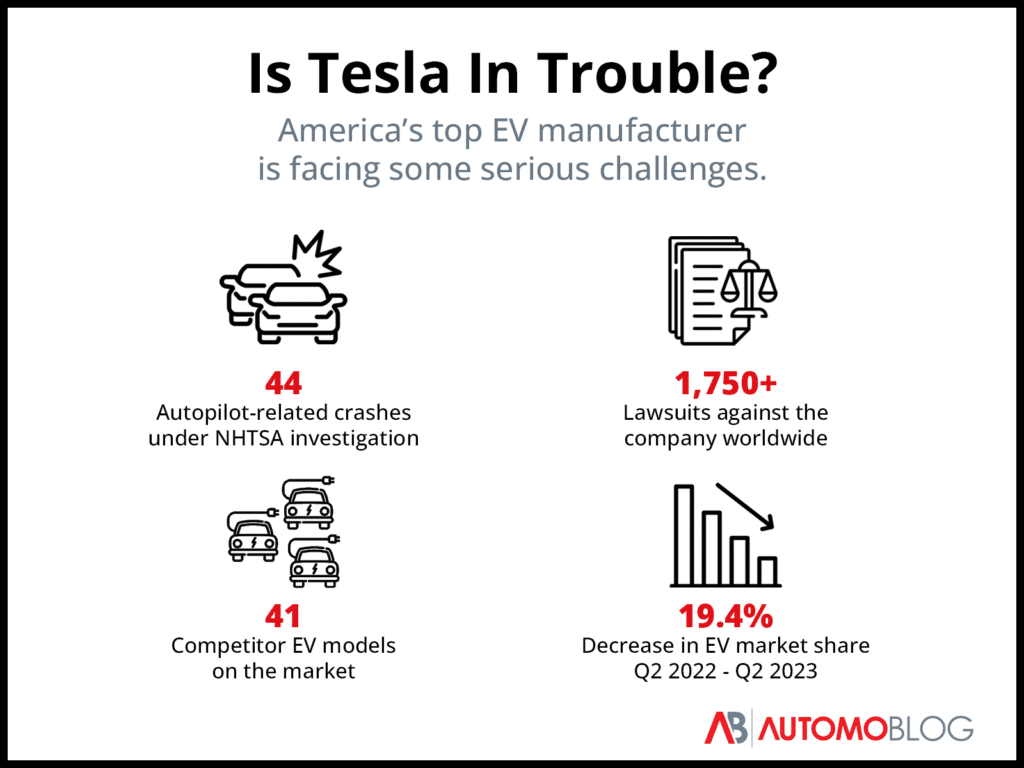

But with multiple government investigations underway, scores of lawsuits in progress, and a series of shifts that suggest difficulty moving inventory, the automaker is facing a host of serious legal and business issues. Is this the beginning of the end of Tesla’s salad days?

Government Agencies at Multiple Levels Are Investigating Tesla

Since Tesla began rolling out “Autopilot” features, fatal crashes related to the use of this technology have made headlines around the world. According to the automaker’s website, “Autopilot is an advanced driver assistance system that enhances safety and convenience behind the wheel [to reduce] overall [driver] workload.” One of the most recent examples of a fatal crash related to Autopilot occurred on July 19, 2023 near Opal, Virginia. As reported by the Associated Press, a Tesla Model Y collided with a truck that was pulling out of a fuel station and ran underneath it, killing the Tesla driver.

Witnesses at the scene said that the driver did not appear to attempt to stop before the collision, which aroused local authorities’ suspicion that the Model Y driver was using Autopilot. As a result, the Fauquier County sheriff’s department requested and executed a search warrant for the vehicle’s data as part of an investigation.

But the local sheriff’s department isn’t the only government agency investigating the crash. In August, the National Highway Traffic and Safety Administration (NHTSA) sent a team to Fauquier County to investigate the collision. The Virginia incident is just the latest to be investigated by the NHTSA. To date, the NHTSA has reportedly opened dozens of investigations into 44 Tesla Autopilot-related crashes that have resulted in at least 32 deaths over the last eight years.

In 2022, the NHTSA released a report stating that Tesla’s Autopilot, also known as advanced driver assistance systems (ADAS), was a factor in 273 collisions during a 10-month reporting period between July 2021 and May 2022. The report also revealed that Tesla vehicles accounted for nearly three-quarters of all ADAS-related crashes reported to the agency over that period – 273 out of 367. This suggests that the Autopilot issues may be more prevalent with Teslas than with other brands of vehicle.

The Company Is Facing a Litany of Lawsuits

Tesla’s legal issues are not limited to investigations by local and federal agencies. The company is also facing a long list of lawsuits – more than 1,750 at press time – in civil courts around the world. At least three of these lawsuits relate to Autopilot-involved fatalities.

However, the issues at the center of these legal battles are wide-ranging and varied. Several involve serious accusations of misconduct. One of the highest-profile cases is related to a Twitter post made by Tesla’s CEO in August 2018 that suggested that he had “funding secured” to take the company private. The tweet was the subject of a complaint by the Securities and Exchange Commission (SEC), which alleged that the CEO and the company violated the Securities Exchange Act of 1934. While a jury ruled in favor of Tesla in one class-action lawsuit in February 2023, several other lawsuits related to the incident are still ongoing.

Another lawsuit filed in New Mexico accused Tesla of making misleading statements about the capability and availability of the company’s Full Self-Driving (FSD) technology, saying Tesla “fraudulently concealed its engineering failures.” Similar claims have been made in a 2022 federal class action lawsuit by customers who say that Tesla has misled people who have bought or leased the company’s vehicles with Autopilot, Enhanced Autopilot, or FSD features. The lawsuit followed an NHTSA recall of more than 300,000 vehicles due to the vehicles being unsafe around intersections.

Tesla is also subject to a suit filed by the California Department of Fair Employment and Housing (DFEH) in 2022 after it received “hundreds of complaints from Tesla workers.” In the suit, the DFEH claims that Tesla discriminates against Black workers and maintains a “racially segregated workplace where Black workers are subjected to racial slurs and discriminated against in job assignments, discipline, pay and promotion creating a hostile work environment.” The California Civil Rights Department filed a similar suit in 2022 based on “a pattern of racial harassment and bias” at the company’s Fremont, California factory.

Other lawsuits involve accusations of misconduct such as sexual harassment, whistleblower retaliation, and consumer privacy violations. Tesla is also subject to additional lawsuits around other technology in its vehicles, such as an Autopilot error that caused cars to brake suddenly and erroneously.

Demand for Teslas May Be Weakening

Since the debut of the Roadster in 2008, demand for Tesla vehicles had mostly outpaced supply of the vehicles. This resulted in long wait times for one of the company’s vehicles due to order backlogs. However, that has started to change in recent months.

According to InsideEVs, people faced backlog-related wait times of several months as recently as this spring for every Tesla model. But while vehicle delivery schedules may still result in a wait for new Tesla owners, there is currently no reported significant backlog for any model. This suggests that demand for the company’s EVs may be weakening in relation to vehicle supply.

Several moves made by the company recently also suggest that demand may be falling. Recently, Tesla announced massive price cuts to several of its models. Since the beginning of 2023, the company has cut the price of Model S vehicles by $30,000 and its Model X vehicles by $41,000 – a 28.6% and 33.9% decrease, respectively.

Some of the motivation behind these price cuts likely has to do with achieving eligibility for Inflation Reduction Act (IRA) EV tax credits, which only apply to vehicles that cost less than $80,000. However, as recently as December 2021, Tesla’s CEO publicly stated his opposition to the tax incentives. In a Wall Street Journal press conference, the chief executive said of Tesla’s competitors, “Maybe they need it, I don’t know.” These latest price cuts suggest that attitudes at Tesla towards the IRA incentives may have changed, perhaps due to weakened demand.

Can Tesla Continue To Dominate the U.S. EV Market?

Even though Tesla is facing an onslaught of challenges, the company is still head and shoulders above its competitors. Tesla continues to claim more than half of the U.S. EV market on its own, with literally every other car manufacturer combined claiming a minority share. However, that could change in the near future.

In April of this year, Tesla held a 58% share of the total U.S. EV market. While this figure shows that Telsa still dominates the industry, it is a substantial drop from a year earlier, when the company held a 72% market share. The rapid loss of market share happened even as overall sales of Tesla vehicles increased more than 35% over the same period.

These numbers tell an important part of the story. While Tesla is embroiled in legal issues and what appears to be waning demand, its biggest challenge may simply be competition. The company’s market-share slide has occurred as other automakers have significantly increased their EV offerings.

When the Tesla Roadster first went into production in 2008, it was the only highway-legal battery-powered EV on the American market. Tesla was a pioneer in the EV space and was, for some time, synonymous with electric vehicles themselves. The Nissan Leaf would not be available until 2010.

However, car buyers in the U.S. today have far more options than they did over the last decade-plus. As of Q3 2023, there are at least 42 battery-powered EVs available to American drivers. Automotive heavyweights like Ford and General Motors have introduced multiple EV models with some of the world’s most recognizable brands and enormous dealership networks behind them. Companies like Mercedes and Lexus have made the luxury EV space – which has been Tesla’s bread and butter – far more competitive. And on the other side of the market, companies like Vietnamese automaker VinFast have introduced low-cost EVs that are accessible to more people.

Drivers who have concerns about the safety of Tesla vehicles, the company’s brand image, or their business practices now have lots of alternatives to choose from. Even if people don’t have specific concerns about Tesla, the development of the EV market has made it possible for shoppers to be more selective about which EV they buy and the manufacturer they buy it from.

It is important to note that loss of market share may not spell automatic disaster for Tesla. The EV market as a whole is growing rapidly, which is why Tesla could see both falling market share and growing sales at the same time between Q1 2022 and Q1 2023. A smaller share of a bigger market could still result in growth for the automaker.

In addition, the company is exploring other revenue opportunities. One of the biggest may be its charging port design, which recently gained a major ally when Ford announced it would manufacture its EVs to be compatible with Tesla-designed North American Charging System (NACS) – formerly known as the Tesla Supercharger. Other automakers seem likely to join Ford in the near future. Widespread adoption of the NACS design could potentially negate Tesla’s losses in the vehicle market by generating user fees for the company.

Tesla may indeed escape its legal troubles relatively unscathed – and currently, it is still the top name in EVs in the U.S. But the company will be fighting those legal battles while competition in the EV market continues to heat up and demand for the company’s vehicles appears to be cooling. Whether it can manage all of those challenges at once may prove to be a pivotal test for the now-iconic brand.